Our Philosophy

A human-driven quantamental approach

We combine data-driven models with fundamental analysis, with our experienced investment team's judgment at the heart of every decision.

Our philosophy rests on four interconnected pillars that guide our investment decisions

Top-down approach

Strategically tilting exposures across geographies and themes, guided by macroeconomic insights from our Head of Macro

Fundamental research

Identifying promising and high-quality companies through rigorous research reports, financial statement analysis and qualitative assessments

Quantitative modeling

Leveraging data and proprietary models systematically screen, rank, and uncover investment opportunities

Bottom-up approach

Narrowing a broad investment universe into a focused selection of high-potential ideas for deeper analysis

Our Fund Strategy

Our Equities RDT-DBI strategy

We apply our quantitative approach to deliver active global equity exposure that goes beyond traditional passive indices

Genuine diversification

We actively manage exposure across regions, sectors, and factors, avoiding benchmark concentration and emphasizing often under-appreciated markets such as Europe and Asia.

Factor-driven returns

By integrating academic-backed factor premia like Quality, Value and Growth, we aim to enhance long-term returns while reducing risks across economic cycles.

Mid to large-cap focus

We invest in resilient large caps and select mid caps offering superior growth potential and high profitability. We look for pricing inefficiencies, focusing on value, quality and growth investing at reasonable prices.

Our Process

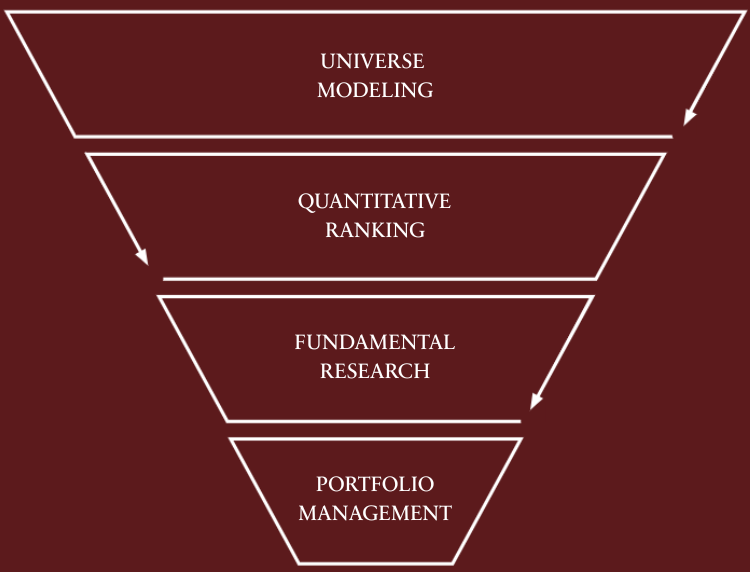

Our Equities RDT-DBI process

From a broad universe to a concentrated portfolio, every step is designed to be rigorous, systematic, and transparent

Universe modelling

Screening mid-to-large caps stocks listed in developed markets. Filtering for liquidity criteria, accounting anomalies and outliers Analysis of stock's eligibility for RDT-DBI regime

Quantitative ranking

Proprietary quantitative model calibrated for each region and factors. Within each sector, stocks are scored against key fundamental and technical parameters and ranked accordingly

Fundamental research

Rigorous fundamental and qualitative analysis supported by our proprietary valuation framework and complemented by external research providers

Portfolio Management

Optimized diversification across regions, sectors and factors Concentrated positions to fully capture convictions Reconciliation of top-down and bottom-up approach

Fund Details

Equities RDT-DBI

A sub-fund of our Belgian institutional SICAV, offering actively managed, long-only global equity exposure while benefiting from the RDT-DBI regime

At a Glance